Understanding the Current Shift in the Real Estate Market: PERSPECTIVE IS KEY!

“How’s the market?” is a question I am asked all the time. It is a common segue in casual conversation over the neighbor’s fence, at a party or family gathering. Now more than ever, the answer to this question is critical and detailed. You see, our market is experiencing a shift, a slowing down of price growth, if you will. Believe it or not, this is providing great opportunities for both buyers and sellers.

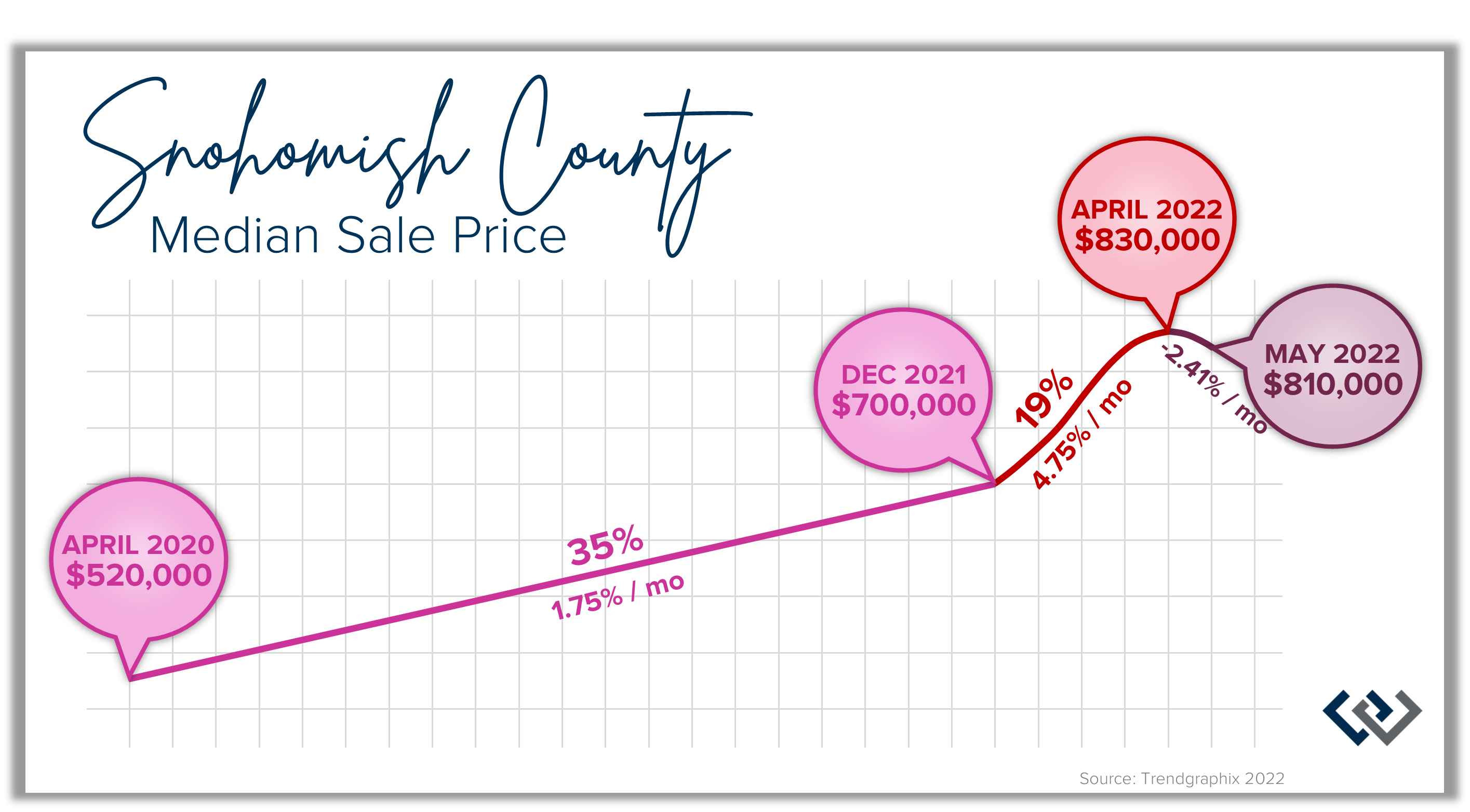

Let’s talk about what the slow down in price appreciation means first. What this means is when we get to the end of the year and average the last 12 months of median price and compare it to the previous 12 months of median price, we will still have a positive growth percentage, but that percentage will be lower than it was earlier in the year. You see, we had a very significant bump in prices in Q1 of 2022 that will level off as we complete 2022. Bear in mind that the long-term annual price appreciation rate is closer to 3-6% when comparing the growth that we’ve had recently.

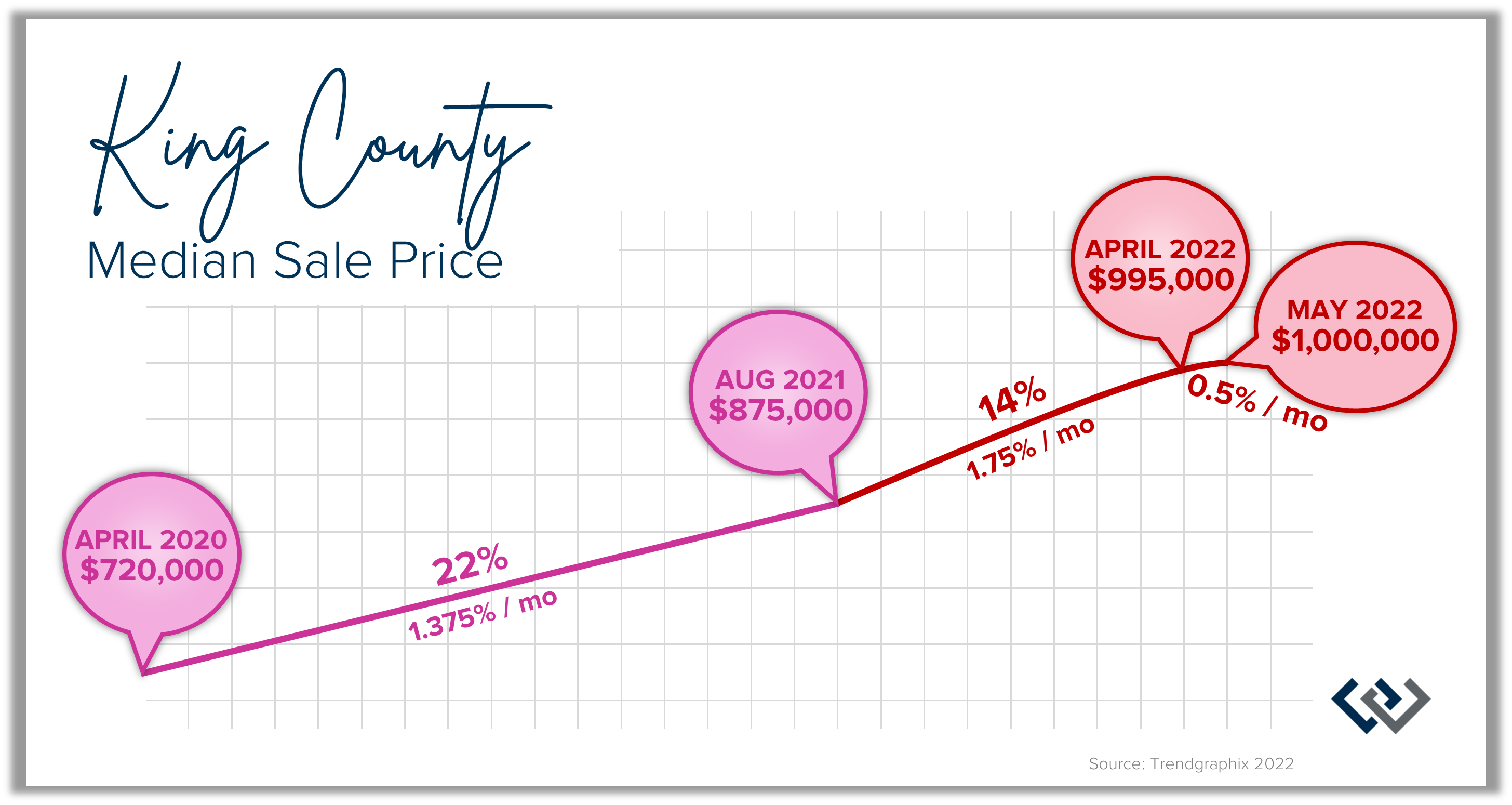

Let me break this concept down for you with some numbers. In Snohomish County, in April of 2020, the median price was $520,000 and in April of 2022 the median price was $830,000 – this is a 60% increase in 2 years! In King County, in April of 2020, the median price was $720,000 and in April of 2022 the median price was $995,000 – this is a 38% increase in 2 years! That pace is unprecedented and unsustainable.

Let’s dig a little deeper! In Snohomish County, in December 2021 (the end of last year) the median price was $700,000 which was an above-average 35% increase from April 2020 (20 months). That means there was a 35% gain from April 2020 to December 2021 (20 months: $520,000 to $700,000 = 35%) but then a whopping 19% gain in 4 months, from December 2021 to April 2022 (4 months: $700,000 to $830,000 = 19%). This 4-month stretch of price growth is the root of the unsustainability and one that we will be leveling off of during this shift. It is very unlikely that we will return to prices below the December 2021 level, which was at an above-average growth rate of 35% from April 2020. The (unofficial) median price in May sits at $810,000 indicating the shift to settle somewhere between the April peak and where we landed at the end of last year. We must remember that we were celebrating price growth at the end of 2021!

Let’s dig a little deeper! In Snohomish County, in December 2021 (the end of last year) the median price was $700,000 which was an above-average 35% increase from April 2020 (20 months). That means there was a 35% gain from April 2020 to December 2021 (20 months: $520,000 to $700,000 = 35%) but then a whopping 19% gain in 4 months, from December 2021 to April 2022 (4 months: $700,000 to $830,000 = 19%). This 4-month stretch of price growth is the root of the unsustainability and one that we will be leveling off of during this shift. It is very unlikely that we will return to prices below the December 2021 level, which was at an above-average growth rate of 35% from April 2020. The (unofficial) median price in May sits at $810,000 indicating the shift to settle somewhere between the April peak and where we landed at the end of last year. We must remember that we were celebrating price growth at the end of 2021!

In King County the numbers are not as extreme, but still well above average growth rates. In August 2021, the median price was $875,000 which was an above-average 22% increase from April 2020 (15 months). That means there was a 22% gain from April 2020 to August 2021 (15 months: $720,000 to $875,000 = 22%) and then a 14% gain in 9 months, from August 2021 to April 2022 (9 months: $875,000 to $995,000 = 14%). This 9-month stretch of price growth is one that will be leveling off during this shift. It is very unlikely we will return to prices below the August 2021 level, which was still an above-average growth rate of 22% from April 2020.

This is where perspective comes in and where pricing can get a little tricky. Coaching potential sellers as to why it would be unrealistic to expect the peak prices of Q1 2022 requires explaining the market factors that have played into this shift. The combination of the lowest inventory levels and lowest interest rates in history that took place in Q1 2022 was the perfect storm that created intense price growth over a short period of time. Now we must navigate the new environment as we chart our real estate goals. Three main factors have led to this much-needed tempering in price growth: inventory, interest rates/inflation, and affordability.

Inventory has finally started to grow although it is still a seller’s market. In Snohomish County, 2021 was an extreme seller’s market that never crested over 0.6 months of inventory; that’s just over two weeks! A seller’s market is defined as 0-3 months of inventory, a balanced market as 3-6 months, and a buyer’s market as 6-months plus. In May 2022, we sit at 0.9 months of inventory (unofficially). We have started to see more homes come to market, providing buyers with more selection. For example, in April 2020 there were 996 new listings; in December 2021 there were 525 new listings; in April 2022 there were 1,503 new listings (almost 3x as much over December), and (unofficially) in May there were 1,654 new listings. This additional selection is providing buyers the long-awaited option to find housing and has started to reduce the number of multiple offers which have put downward pressure on prices. When there is more selection, prices do not escalate as quickly.

In King County, for May 2022, we sit at 0.9 months of inventory (unofficially). In April 2020 there were 2,138 new listings; in December 2021 there were 1,103 new listings; in April 2022 there were 3,353 new listings (just over 3x as much over December), and (unofficially) in May 2022 there were 3,698 new listings.

In King County, for May 2022, we sit at 0.9 months of inventory (unofficially). In April 2020 there were 2,138 new listings; in December 2021 there were 1,103 new listings; in April 2022 there were 3,353 new listings (just over 3x as much over December), and (unofficially) in May 2022 there were 3,698 new listings.

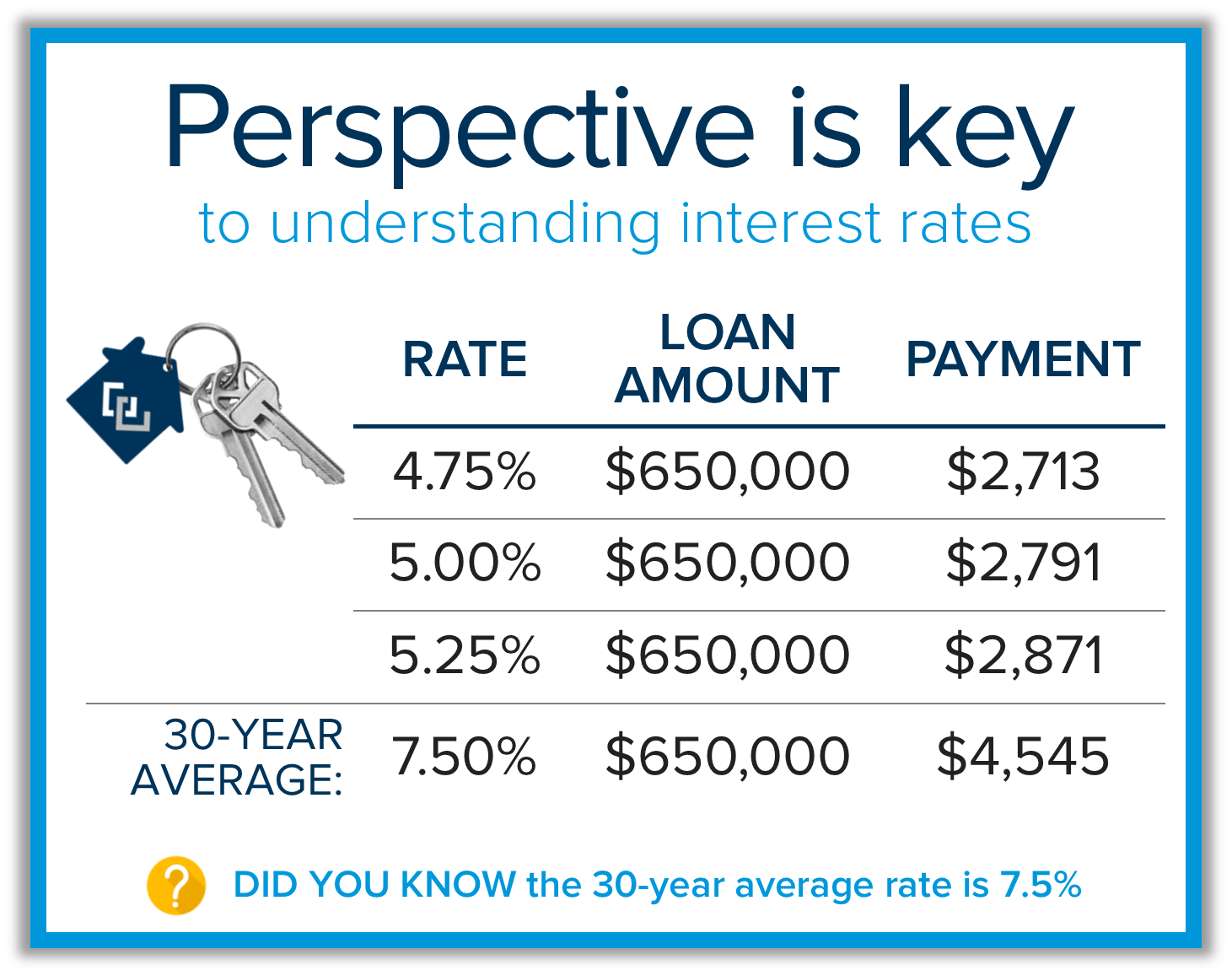

Interest rates have also grown over the last two years and even more specifically since the first of the year. We are currently hovering around 5%. At the start of 2022 we were hovering around 3%. The Fed finally gave way to the promise that rates would rise, which was a necessary tool to combat inflation. While 3%-4% rates were a dream, they were not a long-term reality. The 30-year average for interest rates is 7% which highlights that 5% is a great rate!

It is understandable that 5% pales in comparison to the historic lows we had, but those are most likely only going to be found in the history books in the foreseeable future. Rates being as low as 3% in Q1 2022 played into the rapid acceleration in price because it made the buyer audience larger when we had the least amount of inventory available. The good news is that while they had a quick 2-point increase from March 2022 to May 2022, they have seemed to stabilize. They have even come down a bit, making this our new normal for now, as future increases into 2023 are predicted. The good news for buyers who secured a home in Q1 is they also secured the lowest debt service in history, so they should be very happy.

Affordability has been a challenge for many, especially first-time home buyers. Affordability challenges at December 2021 prices were real, but the rise to April 2022 levels just plain removed buyers from the market. As price appreciation slows and prices level off due to the shift in market conditions, some buyers will be able to reenter the market and start to secure their wealth-building asset that also augments their lifestyle.

So, what does all of this mean? The word that keeps coming to my mind is perspective. We have walked through one of the most extreme seller’s markets of our time, which resulted in rapid price growth for sellers and limited choices for buyers. That is starting to ease up and we need to celebrate this! We are heading towards historical norms and while that is happening, we will need to keep the crazy Q1 price growth in a box alongside the unicorns and rainbows for the lucky sellers that found the pot of gold and buyers who secured the lowest rates ever. Good for them, but still good for anyone who has owned their home for longer than two years, as the amount of seller equity is abundant.

Real estate has always been a long-hold investment and we have lost sight of that with the abnormality of the last two years. Most importantly, real estate is a lifestyle decision. Our homes provide us shelter, community, features, and benefits. We make memories, find comfort, and if we are lucky, we are able to match our home to our lifestyle needs and build wealth at the same time.

With more selection, still-low interest rates, and coming off the crazy prices of Q1, more buyers will be able to make these lifestyle pivots more comfortably, all while sellers will still make phenomenal returns. Perspective is key to help see the forest through the trees, and if not taken into consideration could stall one from reaching their goals.

If you are curious about the value of your home in today’s market or are considering a purchase, please reach out. Even if you just want to talk these changes through and understand how they might affect your long-term goals. It is always my goal to help keep my clients well informed and empower strong decisions.

Every year, my office comes together to provide summer camp scholarships for local kids who may not otherwise have the opportunity to experience the adventures of overnight camp. This year we donated $16,300 to YMCA Camp Orkila and Camp Colman! Overall, since 1994, we are responsible for $230,000 in summer camp scholarships for local kids in need. I am so proud to be part of an office that cares so deeply for the community!

Local Farmers Markets: 2022

When you shop at a local Farmers Market, you’re buying outstanding freshness, quality and flavor. Knowing exactly where your food comes from and how it was grown provides peace of mind for your family. Plus, you’re supporting a sustainable regional food system that helps small family farms stay in business; protects land from over-development, and provides the community with fresh, healthy food. Find one near you on the list below!

South Snohomish County

Arlington Farmers Market

Legion Park: 114 N. Olympic Ave

Saturdays. 10am-2pm

May 8 — September 25

Bothell Park Ridge Community Market

Park Ridge Church: 3805 Maltby Road, Bothell

Wednesdays 4pm-8pm

June —September

Edmonds Museum Summer Market

Historical Museum: 5th St from the fountain

Saturdays 9am-2pm

May 7—October 8

Everett Farmers Market

2930 Wetmore Ave

Sundays 11am-3pm

May 8—October 30

Lake Stevens Farmers Market

1806 Main Street

Wednesdays 3pm-7pm

June—August

Monroe Farmer’s Market

Galaxy Theater: 1 Galaxy Way

Wednesdays 3pm-7pm

May 25-September 7

Snohomish Farmers Market

Union & Glen Ave

Thursdays 3pm-7pm

May —September

Stanwood Farmers Market

8727 271st St NW

Fridays 2pm-6pm

June 3 —October 7

Eastside

Bellevue Farmers Market

First Presbyterian: 1717 Bellevue Way NE

Thursdays 3pm-7pm

May 12—October 6

Bellevue Crossroads Farmers Market

East Parking Lot: 15600 NE 8th St

Tuesdays 12pm-6pm

June 7—September 27

Issaquah Farmers Market

Pickering Barn: 1730 10th Ave NW

Saturdays 9am-2pm

May 7—September 24

Juanita Friday Market

Juanita Beach: 9703 NE Juanita Dr

Fridays 3pm-7pm

June —September

Kenmore Farmers Market

Marina Park: 25 Lakeshore Plaza

Wednesdays 3pm-7pm

June 1—September 28

Kirkland Wednesday Market

Town Square: 6728 NE 181st St

Wednesdays 3pm-7pm

June 1—August 31

Mercer Island Farmers Market

Mercerdale Park: 7700 SE 32nd St

Sundays 10am-3pm

June 5—September 25

Redmond Saturday Market

9900 Willows Rd NE

Saturdays 9am-2pm

May 7—October 29

Sammamish Farmers Market

City Hall Plaza: 801 228th Ave SE

Wednesdays 4pm-8pm

May—September

Woodinville Farmers Market

Schoolhouse District: 13205 NE 175th St

Saturdays 10am-3pm

May—September

Seattle

Ballard Farmers Market

Ballard Ave NW

Sundays. 9am-2pm

YEAR ROUND

Capitol Hill Broadway Farmers Market

E Denny Way (btwn Broadway & 10th Ave)

Sundays 11am-3pm

YEAR ROUND

Columbia City Farmers Market

37th Ave S & S Edmunds St

Wednesdays 3pm-7pm

May 4—October 12

Fremont Sunday Market

Corner of 3410 Evanston Ave N

Sundays 10am-4pm

YEAR ROUND

Lake City Farmers Market

125th St and 28th Ave NE

Thursdays 3pm-7pm

June 16—October 6

Lake Forest Park Farmers Market

Third Place Commons: 17171 Bothell Way NE

Sundays 10am-2pm

May 8—October 9

Madrona Farmers Market

1126 Martin Luther King Jr. Way

Fridays 3pm-7pm

May 13—October 21

Magnolia Farmers Market

Magnolia Village: 33rd Ave W & W McGraw

Saturdays. 10am-2pm

June 4—October 15

Phinney Farmers Market

Magnolia Village: 33rd Ave W & W McGraw

Fridays 3pm-7pm

June 3—September 30

Queen Anne Farmers Market

W Crockett Street & Queen Anne Ave N

Thursdays 3pm-7:30pm

June 2—October 13

Shoreline Farmers Market

192nd St N & Aurora Ave N

Saturdays 10am-2pm

June 4—October 1

University District Farmers Market

University Way NE

Saturdays 9am-2pm

YEAR ROUND

Wallingford Farmers Market

Meridian Park: Meridian Ave N & N 50th St

Wednesdays 3pm-7pm

May 25—September 28

West Seattle Farmers Market

California Ave SW & SW Alaska St

Sundays 10am-2pm

YEAR ROUND

The Gardner Report

At Windermere, we are fortunate to have Matthew Gardner as our Chief Economist. In fact, we are one of the only real estate companies in the country to have such a well-respected expert sitting in this role. Not only is Matthew an asset to Windermere brokers and their clients, but he is a coveted resource within the industry. He is often called upon by major media outlets and industry think tanks for his insights and knowledge.

Every quarter Matthew produces The Gardner Report which explains statistics and trends and provides predictions for all of the market areas Windermere serves, see the links below. What is so great about this is you can read about where you live and also get a glimpse into other markets that may pique your interest.

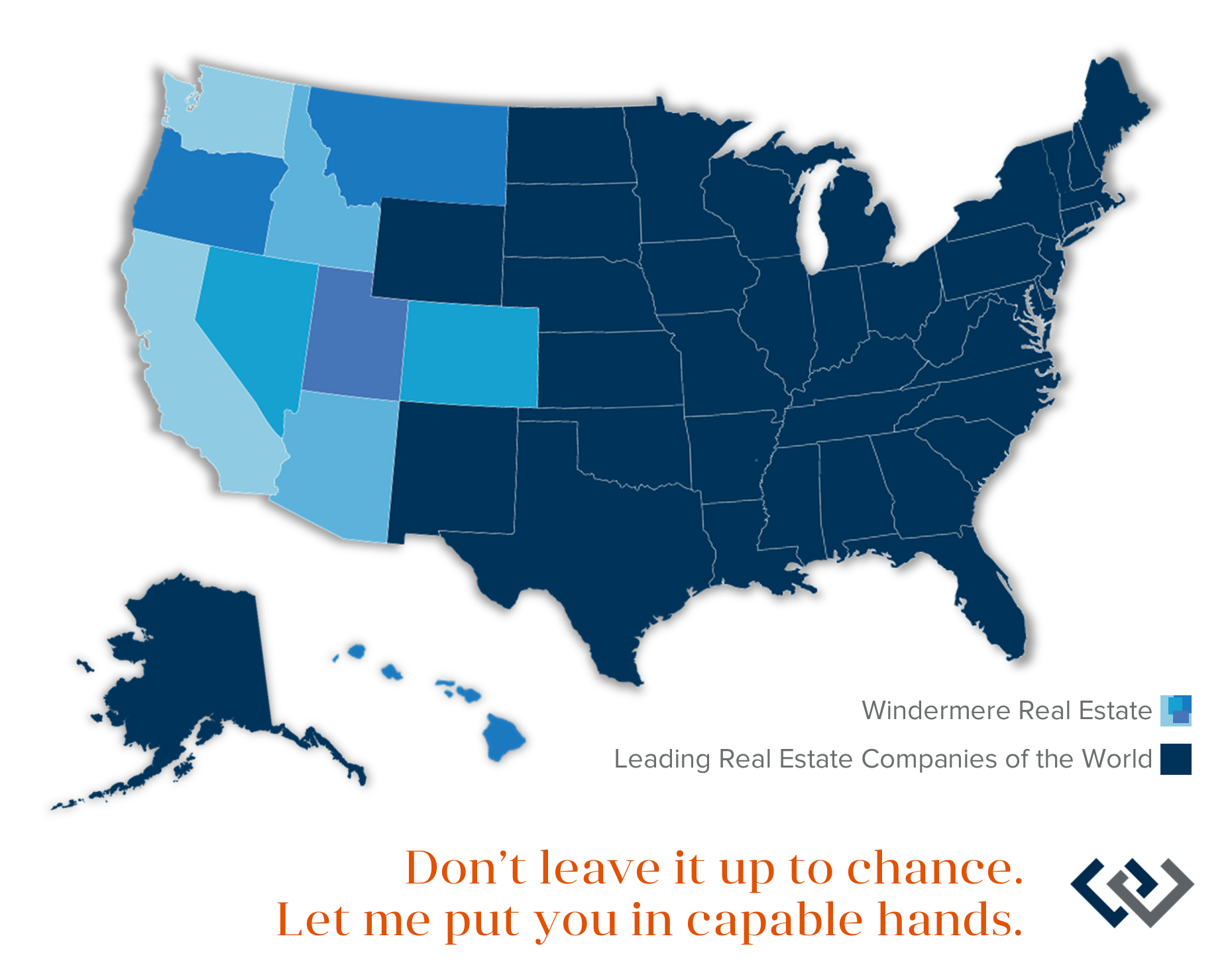

Read the full Western Washington report here. Additionally, since Windermere spans the entire Western Region of the United States, he also provides this same report for Washington (Western, Central & Eastern), Oregon, Idaho, Montana, California (Southern & Northern), Utah, Colorado, and Nevada.

There has been a lot of state-to-state moves over the last few years. Many of these moves have been prompted by retirement, second home purchases, affordability, and remote working opportunities. This is a great way to research other markets you may be interested in. These reports update every quarter; please let me know if you’d like me to send them to you when they update. Also, I am connected to the Windermere-wide network of brokers and can easily find you a reputable broker who would be a stellar match for your real estate needs outside of my normal market area.

Further, I am also a part of a national and international network of real estate companies for referrals outside of the Windermere footprint. This is through Windermere’s affiliation with Leading Real Estate Companies of the World. Bottom line, I can help provide information and can help align you with a trusted real estate advisor anywhere in the world. Please reach out if I can help!

Lastly, Matthew also releases a monthly video that speaks to real estate market hot topics. Here is his latest video that touches on the interest rates, inventory, inflation and more.

My office is working together with our entire Windermere family to hit $50 million raised for our 50th anniversary. Each dollar returns to our community through the Windermere Foundation, helping homeless and low-income families in the neighborhoods we serve.

Help us reach our goal by donating here!

Being part of an office and a company that cares deeply for the community is so important to me, and I’m excited to watch these numbers grow! We are currently wrapping up a donation drive among our Windermere North brokers to help send kids to YMCA summer camps. Look for those final numbers in the coming weeks!

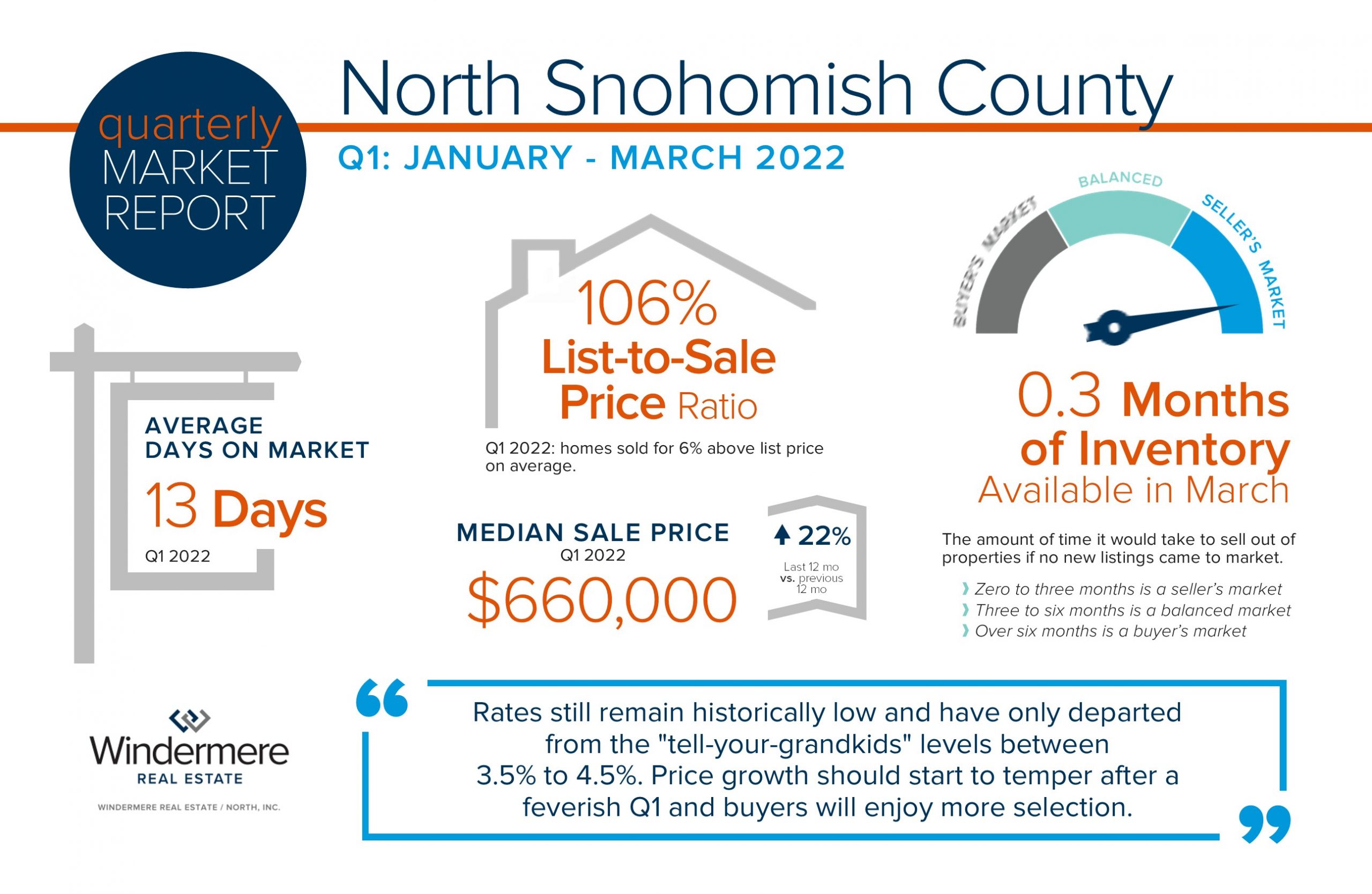

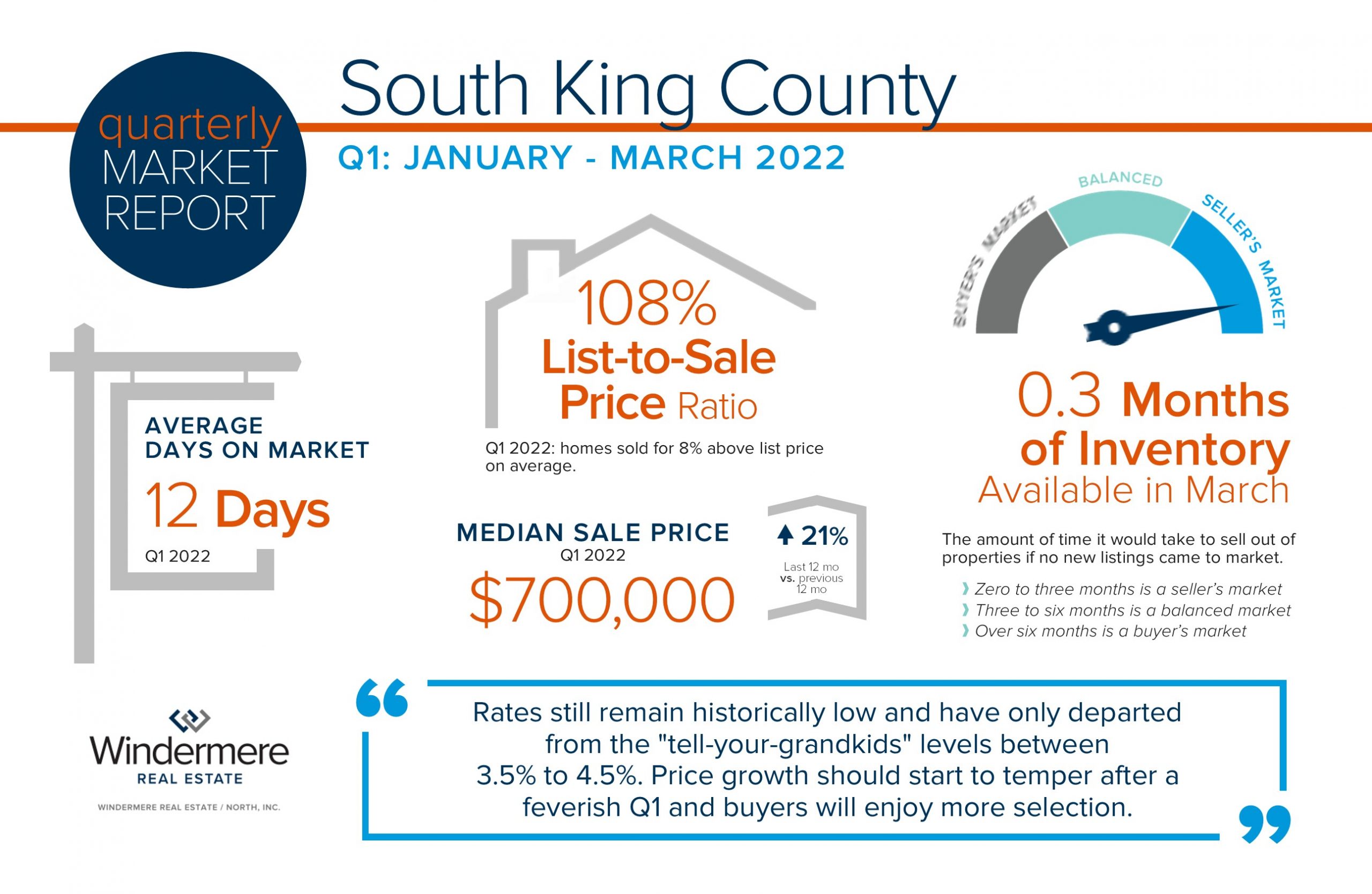

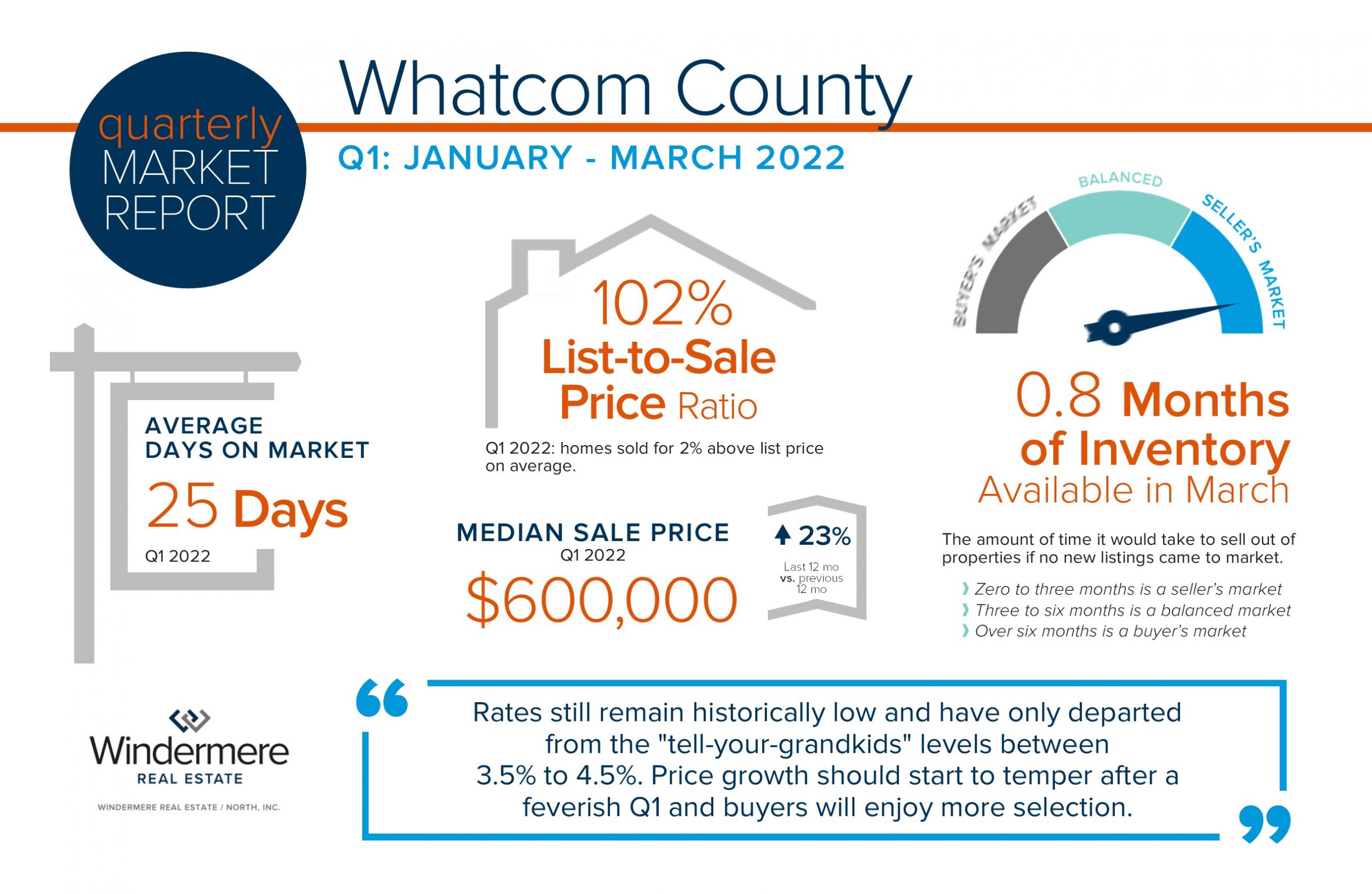

Quarterly Reports – Q1 2022

The 2022 real estate market started with a bang! We started the year with the lowest amount of available inventory we’ve ever seen coupled with interest rates a point lower than they are now, along with a plentiful buyer pool due to a strong job market and work-from-home influenced moves. The combination of supply and demand and low debt service created an intense seller-centric environment which resulted in huge home price increases from January to March. This is on top of ten years of solid price growth; over 50% of homeowners in WA state have at least 50% home equity.

As we head into the spring and summer months, we anticipate seasonal increases in inventory, which will provide much-needed selection for buyers. Interest rates have increased as a tool to combat inflation, which was predicted by experts across the nation and announced by the Fed. Rates still remain historically low and have only departed from the “tell-your-grandkids” levels between 3.5% to 4.5%. Price growth should start to temper after a feverish Q1 and buyers will enjoy more selection. If you are curious about how your real estate goals match up with the market, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

Spring Market in Bloom – Keeping Perspective is Paramount

As we round out the first quarter of 2022 and head into the notorious Spring Market there are a handful of factors that should be considered whether you are a buyer or a seller. Paying attention to the anticipated increase in housing supply, monitoring buyer demand, and assessing the effects of rising interest rates on the market, are current influencers but also have some historical merit. How will these factors affect home prices, buyer opportunities, and overall market conditions? It is important that as we look forward, we also look back, as keeping a well-researched, educated perspective will lead to success.

HOUSING INVENTORY IN BLOOM

April through July historically have the most homes coming to market during a given year. We are sitting at the starting line of selection! Buyers who have been battling through the first quarter (Q1) and find themselves discouraged need to stay calm and carry on into these listing-heavy months. The increase in supply will provide opportunities to win a house as more selection will decrease the number of offers on each house. We are already starting to see the double-digit multiple offers temper to 3-6 offers and sometimes even just one, as the number of listings has grown month-over-month since January.

This increase in supply will also start to moderate price escalations. There were very large price escalations in Q1; the average list-to-sale price ratio in February 2022 in Snohomish County was 10% and 11% in King. Many new listings will come to market this spring on the shoulders of those price gains which will reduce the escalation amounts. We like to call this stair-stepping up the list price based on recent sales. We still anticipate price appreciation but expect the month-over-month growth to decelerate off of these high peaks in Q1. This will create some ease for buyers who stay engaged with their home search.

BUDDING BUYER DEMAND CONTINUES TO OUTPACE SUPPLY

As we track pending sales through March, they continue to track with or outpace new supply depending on which area. This is an indicator that there will continue to be buyer demand to sustain the increase in new listings that are coming this spring. Many buyers are still positioning their pandemic-influenced housing needs and making moves due to work-from-home options. In addition, there is a large population of Baby Boomers transitioning to their right-size homes and a wave of Millennials are poised to make their entrance into homeownership. Buyer demand will be met with more selection over the coming months.

Speaking of first-time buyers, it is extremely important that they understand that besides the lifestyle decision of owning a home, they are making an important investment. Real estate is one of the strongest, if not the strongest wealth-building assets available. Paying towards your own asset vs. your landlord’s will help build net worth as your home appreciates. As a first-time buyer, it is as much about securing the wealth-building asset as it is about choosing an ideal place to live. Buyers always need to make concessions on either price, location, or features, but in the end, will end up with an appreciating asset that will start to build their financial future.

Speaking of first-time buyers, it is extremely important that they understand that besides the lifestyle decision of owning a home, they are making an important investment. Real estate is one of the strongest, if not the strongest wealth-building assets available. Paying towards your own asset vs. your landlord’s will help build net worth as your home appreciates. As a first-time buyer, it is as much about securing the wealth-building asset as it is about choosing an ideal place to live. Buyers always need to make concessions on either price, location, or features, but in the end, will end up with an appreciating asset that will start to build their financial future.

GROWING INTEREST RATES

Interest rates have taken a ride up over the last month as the first increase by the Fed was made to help combat inflation. An increase in interest rates has been predicted for some time, and it is finally happening after several years at all-time historic lows. It will be critical that buyers monitor the rates closely to make sure they relate the monthly payment to the price they are able to and willing to pay. Also, buyers can get creative with their lender and choose to buy down their rate in order to secure a lower rate, hence a lower monthly payment. Aligning with a skilled lender to help navigate the changing environment will be critical.

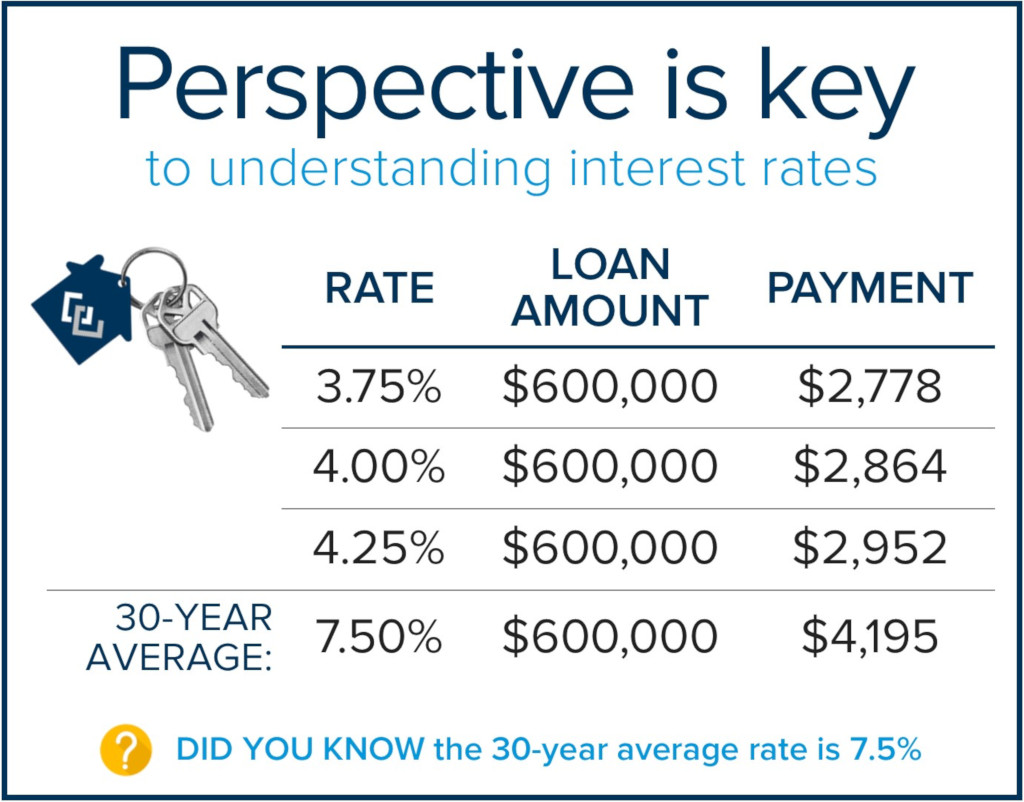

It is also important for consumers to understand that rates are still well below the 30-year average of 7.5%. This perspective is key, along with understanding that rates are probably not to their 2022 peak yet according to the experts. Acting sooner rather than later will help secure a lower debt service for your long-term investment. While the “tell-your-grandkids” rates of 2.75-4% may be gone, there is still an amazing story to tell where we sit now!

It is also important for consumers to understand that rates are still well below the 30-year average of 7.5%. This perspective is key, along with understanding that rates are probably not to their 2022 peak yet according to the experts. Acting sooner rather than later will help secure a lower debt service for your long-term investment. While the “tell-your-grandkids” rates of 2.75-4% may be gone, there is still an amazing story to tell where we sit now!

WHAT DOES THIS ALL MEAN FOR PRICES?

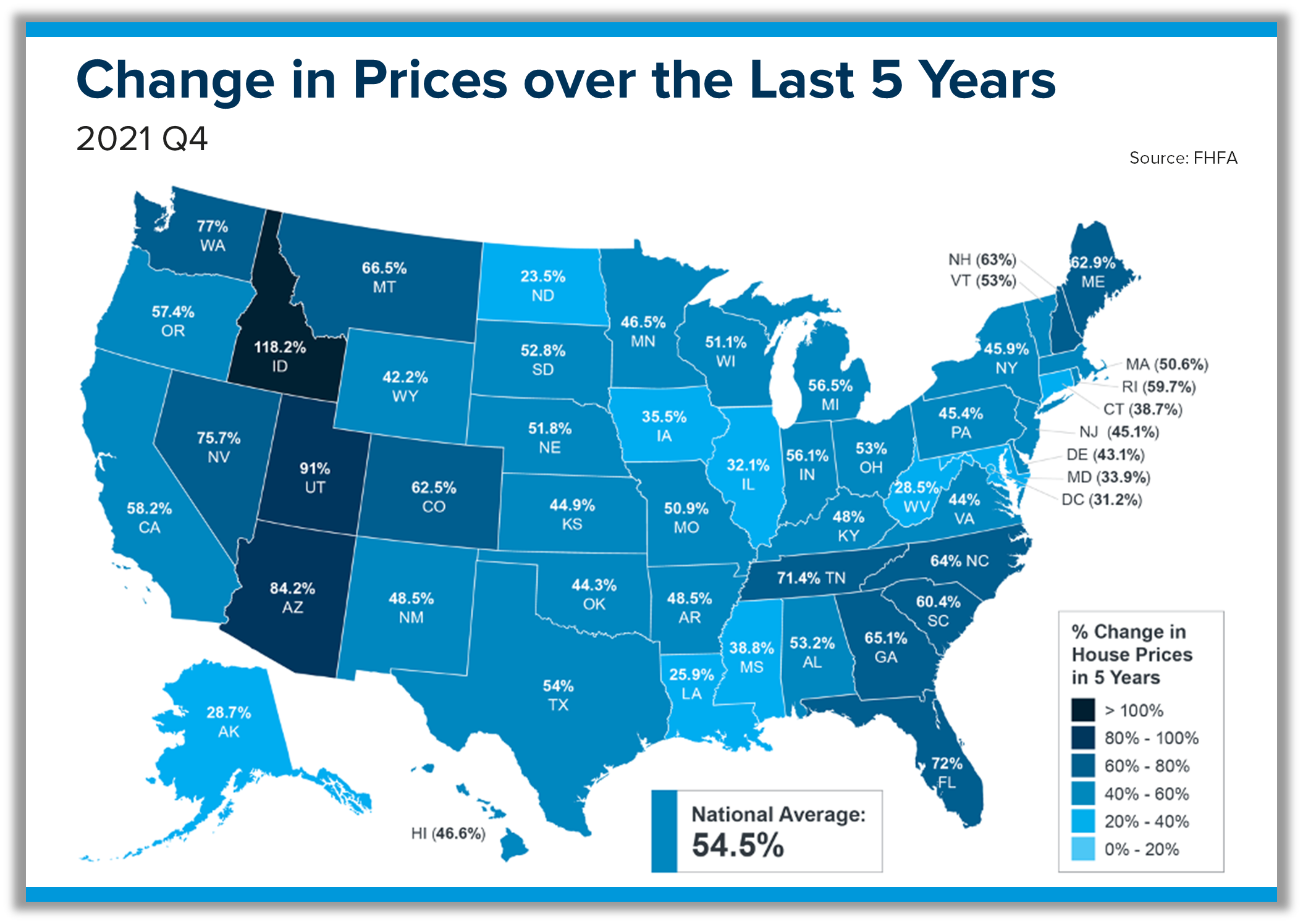

Seasonal increases in selection will start to temper the month-over-month increases in prices and higher rates may put downward pressure on price growth, but homeowners are still sitting on top of a heap of price appreciation. Price appreciation over the last 5 years has been formidable across our nation.

In Snohomish County, prices are up 23% complete year-over-year and up 73% from 5 years ago. In King County, prices are up 15% complete year-over-year and up 54% from 5 years ago. Historical average price appreciation is closer to 3-5% annually, so taking into account gains over the last handful of years is important to have a balanced perspective. The bottom line is sellers are equity rich and have advantageous options to make moves!

In Snohomish County, prices are up 23% complete year-over-year and up 73% from 5 years ago. In King County, prices are up 15% complete year-over-year and up 54% from 5 years ago. Historical average price appreciation is closer to 3-5% annually, so taking into account gains over the last handful of years is important to have a balanced perspective. The bottom line is sellers are equity rich and have advantageous options to make moves!

If you have been considering a move and are curious about the value of your home in today’s market, please reach out. I would be happy to assess your home’s value and help you start to formulate a plan. If you have been beaten up as a buyer in Q1, I urge you to stay in the game, you are at the cusp of opportunity. Buyers and sellers need each other now, more than ever. There will be more flexibility in the market with more selection. The inventory environment we have been in has been so intense. We are ready for the intensity to ease and for the market to be a bit more fluid.

All indicators point toward another positive year in real estate as we enter the spring market. It is always my goal to help keep my clients informed and empower strong decisions. Please reach out if I can help you or someone you know navigate their real estate goals.

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Saturday, April 9th, 10AM to 2PM*

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

This is a paper-only event. No x-rays, electronics, recyclables, or any other materials.

We will also be collecting non-perishable food and cash donations to benefit Volunteers of America Western Washington food banks. Donations are not required, but are appreciated. Hope to see you there! *Or until the trucks are full

UPDATE: Global influences on the Housing Market & Interest Rates

A lot has happened in our world since the first of the year, specifically the rise in inflation and the recent Russian invasion of Ukraine. These factors can influence consumers and affect the housing and financial markets. Additionally, global unrest has had a clear influence on interest rates, driving them back down after a 1-point increase since November 2021.

Please listen to the latest video update from Windermere’s Chief Economist, Matthew Gardner (link below) that was released this Monday, 3/7/22. He provides updated insights and projections for the housing market and interest rates for 2022 and beyond, some of which have been adjusted since his January forecast.

It is always my goal to help keep my clients informed and empower strong decisions. At Windermere, we are so fortunate to have Matthew in our corner providing such expertise to help us help our clients strategically navigate the environment. Please reach out if you have any questions or if you would like to discuss how your goals relate to the market.

As Matthew stated in the video above, it is important that we keep interest rates in perspective. The chart below illustrates where rates are hovering today and where he and other experts expect to see them by the end of the year and how that affects monthly mortgage payments (principal & interest only).

We also have included the 30-year average rate to show the historical significance of today’s low rates. Even though rates have come up 1 point since the absolute bottom level in January 2021, they are still much lower than the historical average, and they are helping to offset affordability challenges.

However, at some point, rates could reach 5% which could put downward pressure on prices like the last time rates reached that level in the latter part of 2018. It is all about how the monthly payment pans out based on the rate. The variable effect of rates on prices will find its balance based on buyer appetites for monthly payment amounts.

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with Confidential Data Disposal to provide a safe, eco-friendly way to reduce your paper trail and help prevent identity theft.

Saturday, April 9th, 10AM to 2PM*

4211 Alderwood Mall Blvd, Lynnwood

Bring your sensitive documents to be professionally destroyed on-site. Limit 10 file boxes per visitor.

This is a paper-only event. No x-rays, electronics, recyclables, or any other materials.

We will also be collecting non-perishable food and cash donations to benefit Volunteers of America Western Washington food banks. Donations are not required, but are appreciated. Hope to see you there!

*Or until the trucks are full

With seller equity at an all-time high, it is still important who you align with to get the best results

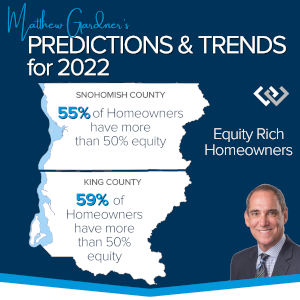

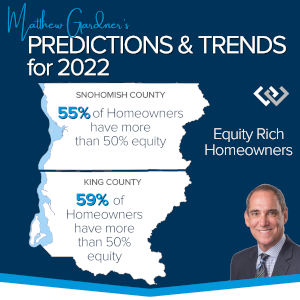

2022 has had an incredibly eventful start in our local real estate market. In January, the average list-to-sale price ratio (the percentage a house sells for in comparison to the list price) in King County was 105% and in Snohomish County it was 106%.  This is in conjunction with complete year-over-year median price appreciation (the last 12 months of price growth averaged and compared to the previous 12 months of price growth) of 15% in King County and 23% in Snohomish County. In fact, 59% of homeowners in King County have more than 50% home equity and 55% of homeowners in Snohomish County have over 50% home equity.

This is in conjunction with complete year-over-year median price appreciation (the last 12 months of price growth averaged and compared to the previous 12 months of price growth) of 15% in King County and 23% in Snohomish County. In fact, 59% of homeowners in King County have more than 50% home equity and 55% of homeowners in Snohomish County have over 50% home equity.

With that said, how does one navigate successfully transitioning that equity to their next move, and who do they choose to help them with the job? With inventory at an all-time low and interest rates still hovering around 4%, buyer demand is high. There is no denying that homes sell quickly in this environment and oftentimes for over list price due to multiple offers. There are many different business models available to consumers when selecting who they align with to help them make this very important move. There are brokerages that will offer an up-front rebate on the commission and there are full-service brokerages, with a lot in between.

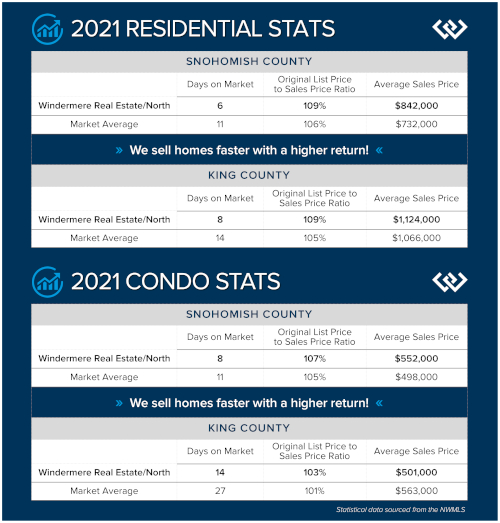

Before I highlight what a full-service brokerage, like Windermere North, has to offer a seller I want to show you some numbers rooted in seller results. In 2021, my office, Windermere North, outperformed the market – we sold homes faster and at a higher return!

Even as we track our statistics so far in 2022, according to NWMLS data, my office’s average list-to-sale price ratio for King and Snohomish Counties combined, including both residential and condo sales, was 114% and 4 days on the market. This compares to the average market results of 105% and 19 days on the market.

Even as we track our statistics so far in 2022, according to NWMLS data, my office’s average list-to-sale price ratio for King and Snohomish Counties combined, including both residential and condo sales, was 114% and 4 days on the market. This compares to the average market results of 105% and 19 days on the market.

Our approach involves a strategic home preparation process, detailed price analysis, and keen negotiations. You might ask what type of negotiations happen when a seller is reviewing a stack of offers; actually, more than you know. Sifting through the terms of offers and vetting the buyers through rapport-building with their broker and lender helps us unearth who the most qualified buyer is to get into contract with. This takes extra time and skilled communication, but as you can see, these extra steps pay off for our sellers.

We also understand that getting a home ready for market can be a daunting task, but the upside is too measurable to ignore. We help our clients identify a punch-list of prep items and match them up with concierge-level service providers to help complete the work. Even if our sellers are limited in funds to prep their home, we have funds available for no up-front costs. Please reach out if you think this would be helpful.

Then the merchandising comes in (depending on the house): staging, professional photography, video, floorplans, print materials, and public exposure is planned and executed. Our listings hit the market perfectly positioned for buyers to see themselves living there and we invest in this on behalf of our sellers. We help connect the emotional dots that invoke buyers’ lifestyle goals resulting in high returns for our sellers.

Lastly, perspective is key! Markets shift, ebbing and flowing. Pricing a home is strategic and requires analysis of the recent sales, historical seasonality, and current market trends. This research is done sifting through data, but also with intangible outreach to fellow brokers inquiring about their experiences and gleaning conclusions. Also, physically touring the inventory, whether I’m showing buyers or walking through to see for myself, helps me understand how a home measures up and what buyers are looking for. All of these steps are over-and-above the norm and help contribute to the results my office is producing.

If you are considering a move, make sure you align yourself with a trusted advisor who is willing to put in the extra work to get you the best possible results. Navigating an extreme sellers’ market takes great skill and care to garner the best results. If done right, that skill and care will beat out any upfront discount a less-engaged broker will offer to win a listing. Make sure you consider the big picture, not just an immediate reward. Understand that who you choose to partner with to assist you with one of the biggest financial decisions a person ever makes is a very big deal. It is always my goal to help keep my clients well-informed and empower strong decisions. Please reach out if you think I can help you or someone you know, whether you are just curious about the market or you’re ready to make a move.

Cheers to 50 Years!

Cheers to 50 Years!

Fifty years of relationships, 50 years of giving back to our communities, and 50 years of growth. In 1972, Windermere Real Estate was founded by John Jacobi in the Sand Point neighborhood of Seattle, WA. Since then, Windermere has expanded to 10 states including Washington, Idaho, Oregon, Montana, California, Arizona, Nevada, Utah, Hawaii, and Colorado. Our network reaches over 300+ offices and 7,000+ brokers. I can tap into our network of offices in the states above and I can also access Leading Real Estate Companies of the World beyond our Windermere network to help you find a like-minded broker for your out-of-area needs.

Even better, Windermere has donated just over $46 Million through the Windermere Foundation, giving funds back to the communities in which we serve. Windermere’s collective goal in 2022, is to get the Windermere Foundation to the $50 Million mark to help commemorate this monumental anniversary. Here’s to another impactful 50 years serving our communities through relationships, homeownership, and community outreach.

Matthew Gardner’s 2022 Predictions for the Local Economy & Real Estate Market

Last week, my office hosted our 14th annual Economic Forecast Event with Matthew Gardner, Windermere’s Chief Economist. It was an hour-long presentation followed by lively Q & A that was packed with useful information to help guide us as we start the new year. Matthew journeyed the audience through a macro to micro approach, reflecting on all of the activity in 2021 and also analyzing future trends.

He started with a national overview of the economy overall and ended with a detailed accounting for King and Snohomish County housing markets, including some predictions. Below are some highlighted bullet points. Please reach out if you would like a digital copy of his PowerPoint and/or the link to the recording of his presentation.

National Economy:

The GDP (Gross Domestic Product) growth in 2021 was 3.9%, well above the long-term average of 2%. This indicates we are not in a recession and have recovered from the brief recession we experienced in the spring of 2020. A recession is defined by two consecutive quarters with declining GDP.

Matthew anticipates the U.S. to be back to full employment by the end 2022 after the fall-out of 2020 due to the pandemic shut-down.

Inflation:

Inflation peaked in Q4 of 2021 and is projected to start to slow as supply chain issues improve. Certain industries such as used cars which are costing 25% more since February 2020 are having a huge influence on overall numbers. Food and energy prices are also volatile and affecting overall numbers.

U.S. Housing Market:

Improved supply chain and labor forces will increase the number of new builds, increasing inventory to help quench buyer demand. This will slow national year-over-year price growth to 6.5% in 2022.

Regional Economy:

Jobs are increasing and will recover from the spring 2020 fall-out twice as fast as the job losses we saw during the Great Recession of 2008. In fact, he expects local jobs to fully return by the end of 2022!

Our diverse economy which includes tech, aerospace, biotech, and manufacturing will help our overall economy thrive as we are not dependent on just one industry for a full recovery.

Mortgage Rates:

Mortgage rates are predicted to slowly rise in 2022. Matthew along with the National Mortgage Brokers Association, Fannie Mae, and the National Association of Realtors expect rates to end the year just under 4%. This is well below the long-term average of 7.5%!

Prices:

In 2021, prices were up 14% year-over-year in King County and 24% in Snohomish County. He predicts housing prices to rise 13% in King County and 14% in Snohomish County in 2022. This is well above the long-term average of 5.5% year-over-year!

The Work from Home phenomenon has had a huge influence on price growth in the suburbs. Many buyers have eliminated long commutes or are only having to drive into work a handful of days a month. This has driven many buyers to consider the suburban markets which is why the price growth in Snohomish County was much higher than King. Seattle saw a bit of a correction as this new lifestyle shift came to be. He anticipates 2022 to be kind to urban markets and a continued attraction to the suburbs.

In 2021, net in-migration in both King and Snohomish Counties was up, which is continuing to have a strong influence on buyer demand. In fact, new listings were up in 2021 over 2020; it was increased buyer demand that whittled down inventory levels and drove prices up.

Homeowner Equity:

Prices have been growing since 2012 and have had historic growth over the last two years. In King County, 59% of homeowners have 50% or more equity in their homes and in Snohomish County, 55% of homeowners have 50% or more home equity.

This uptick in home equity and the Work from Home shift has reduced the average tenure a homeowner spends living in their home to just shy of 7 years in 2021 from 10 years just two years ago. This is another indicator of buyer demand.

Are we Headed Towards a Housing Bubble?

Simply put, no! Even with forbearance being a viable option to weather the fall-out from the pandemic, there will not be a wave of foreclosures on the horizon. Homeowners have too much equity to walk away, they will sell and take their profits in order to recover if need be.

Prices have made a big run, but if you take interest rates and inflation into consideration, monthly payments are only up 26% since 2000 in King County and 34% in Snohomish County. That is parallel to raw home prices being up 249% since 2000 in King County and 272% in Snohomish County.

Financial indicators such as recovering jobs, deep homeowner equity, stringent lending practices, strong buyer demand, and low interest rates combat any inkling of a housing bubble. There are 600k Millennials in King County and 171k in Snohomish County that are coming of age and will want to buy a house.

Condominiums:

Condo sales stalled when the pandemic hit as people decided if they wanted to live in such density, and the downtown core suffered due to the shutdown. Since then, the stall started to move forward and condo prices are up 7% year-over-year in King County and 23% in Snohomish County. Condos provide a more affordable option, especially for first-time buyers, and single-level, maintenance-free living for retirees. Condos are predicted to appreciate 4% in King County in 2022 and 7% in Snohomish County.

Luxury Market:

2021 was the year that the $1M home sale price became more common. In 2021 there we 11k sales over $1M in King County compared to 7k in 2020. In Snohomish County, there were just shy of 2k sales over $1M in compared to 590 in 2020. The $1M price point may not be synonymous with the definition of luxury any longer. It is more so a depiction of affordability in our region. With that said, homes in the very high-end have had brisk movement and marked appreciation.

Overview:

The Work from Home lifestyle is real and has created lots of movement in the marketplace, especially towards the suburbs. This has caused an upward trajectory on price appreciation along with continued low interest rates. New listings outpaced 2020, but buyer demand gobbled up the inventory leaving us at the lowest levels we have ever seen as we start 2022. Price appreciation will continue but is predicted to decelerate after record-breaking levels in 2021. Interest rates will creep up by the end of 2022 and inflation will improve as the supply chain recovers. Homeowner equity is at an all-time high and jobs are recovering, offsetting any big crash to the housing market. Affordability is our biggest roadblock as the landscape of the PNW has changed with tech jobs the heart of our renewed economy.

If you attended our Virtual Economic Forecast Event last week with Matthew Gardner, did you see the mountain of socks?! Matthew is a bit of a sock aficionado, and we usually give him a gift of some fun or funny socks at our yearly event. This year, we decided to collect socks and donate them in Matthew’s name to Beautiful Soles for local kids in need. I am happy to report we collected 523 pairs of socks and $125 amongst our brokers.

Thank you to everyone who gave to our Healthcare Worker Meal Drive in December! We raised $4,360 which enabled us to deliver meals and snacks to frontline workers at Providence in Everett, Swedish Edmonds, and UW Medicine Northwest Hospital. We partnered with We Got This Seattle, who helped us coordinate the restaurants we ordered from and set up our contacts at the hospitals. I am so grateful for ALL of our local frontline workers who have been working so long and hard under the most difficult circumstances.

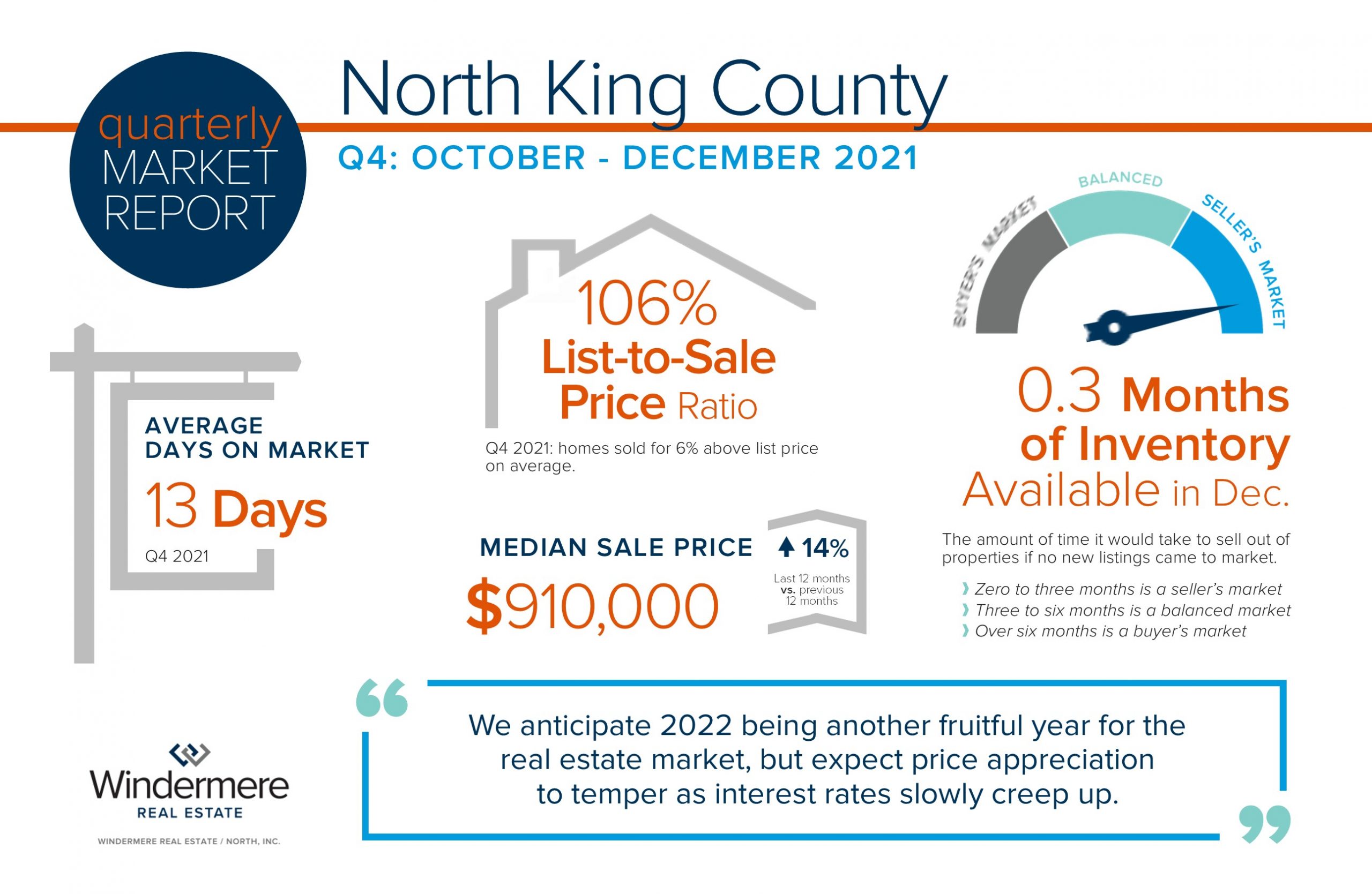

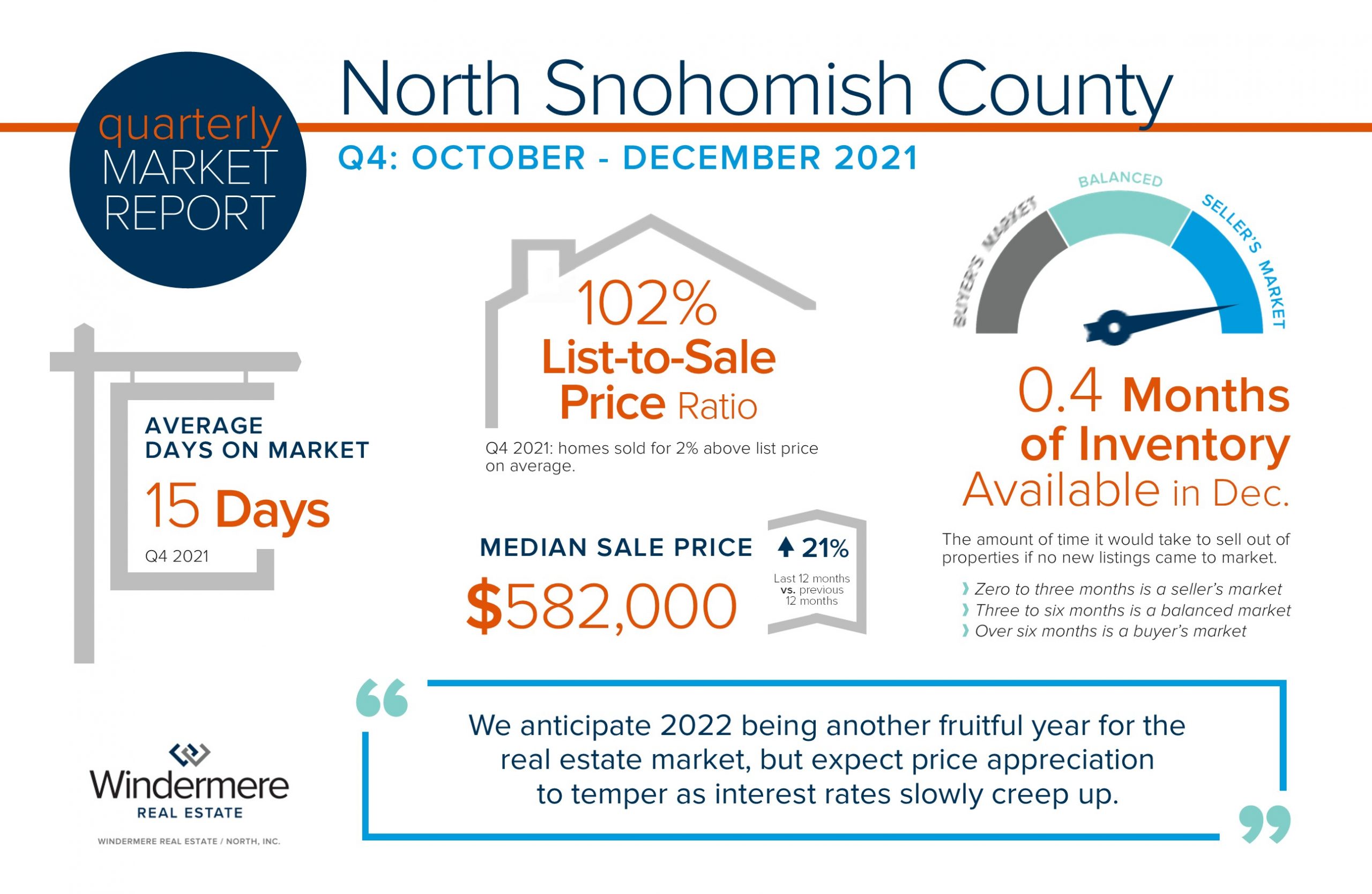

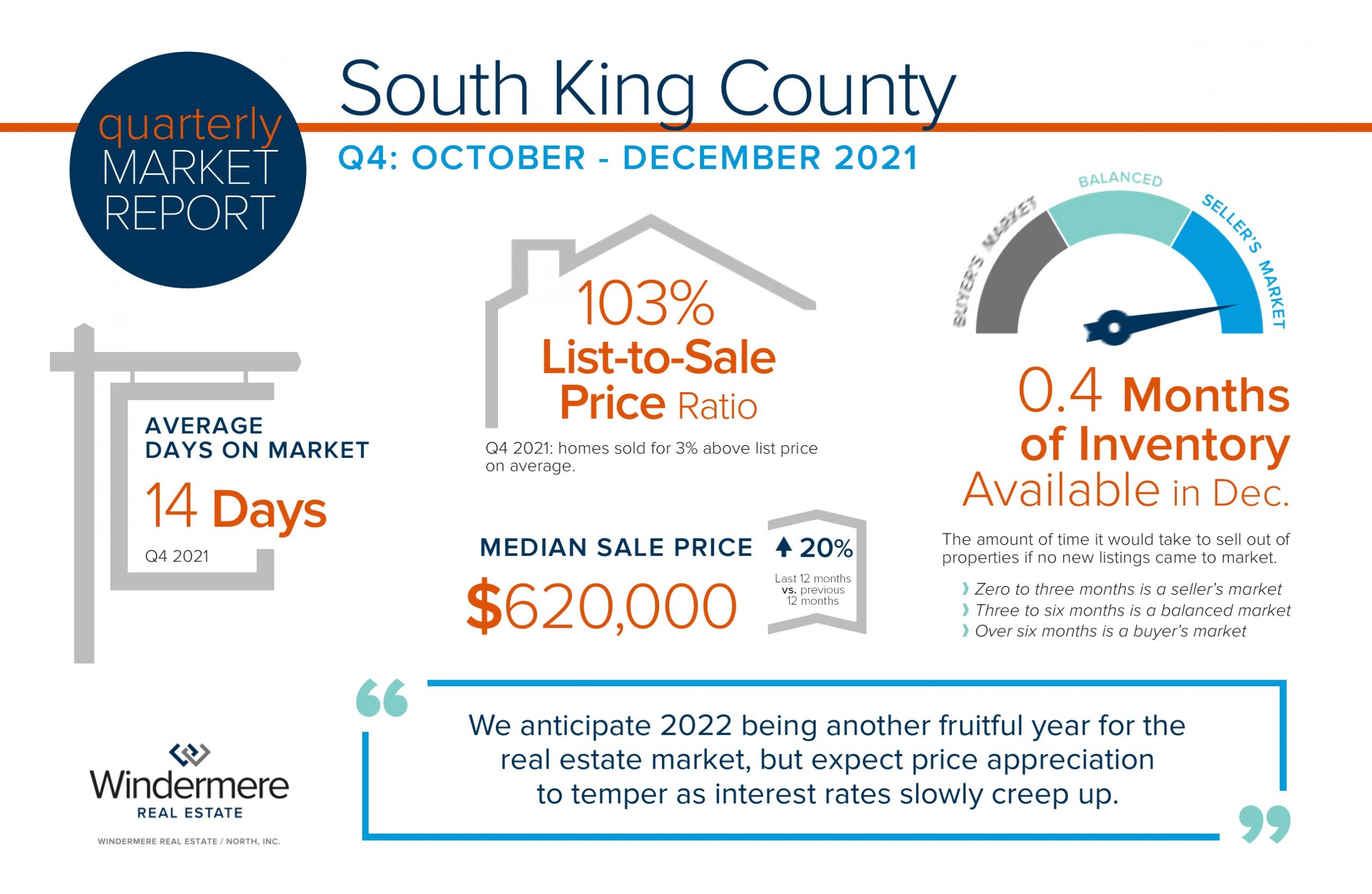

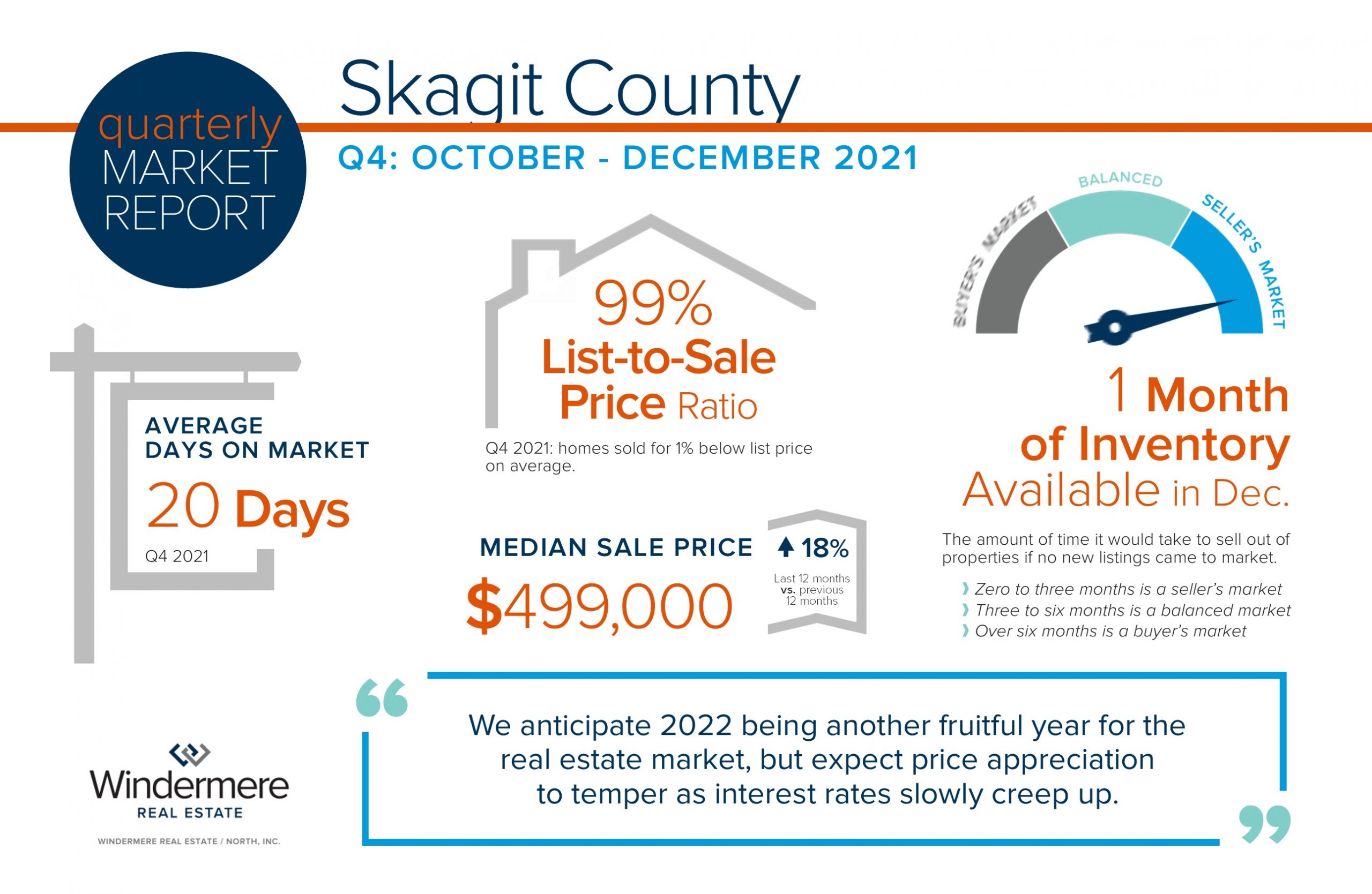

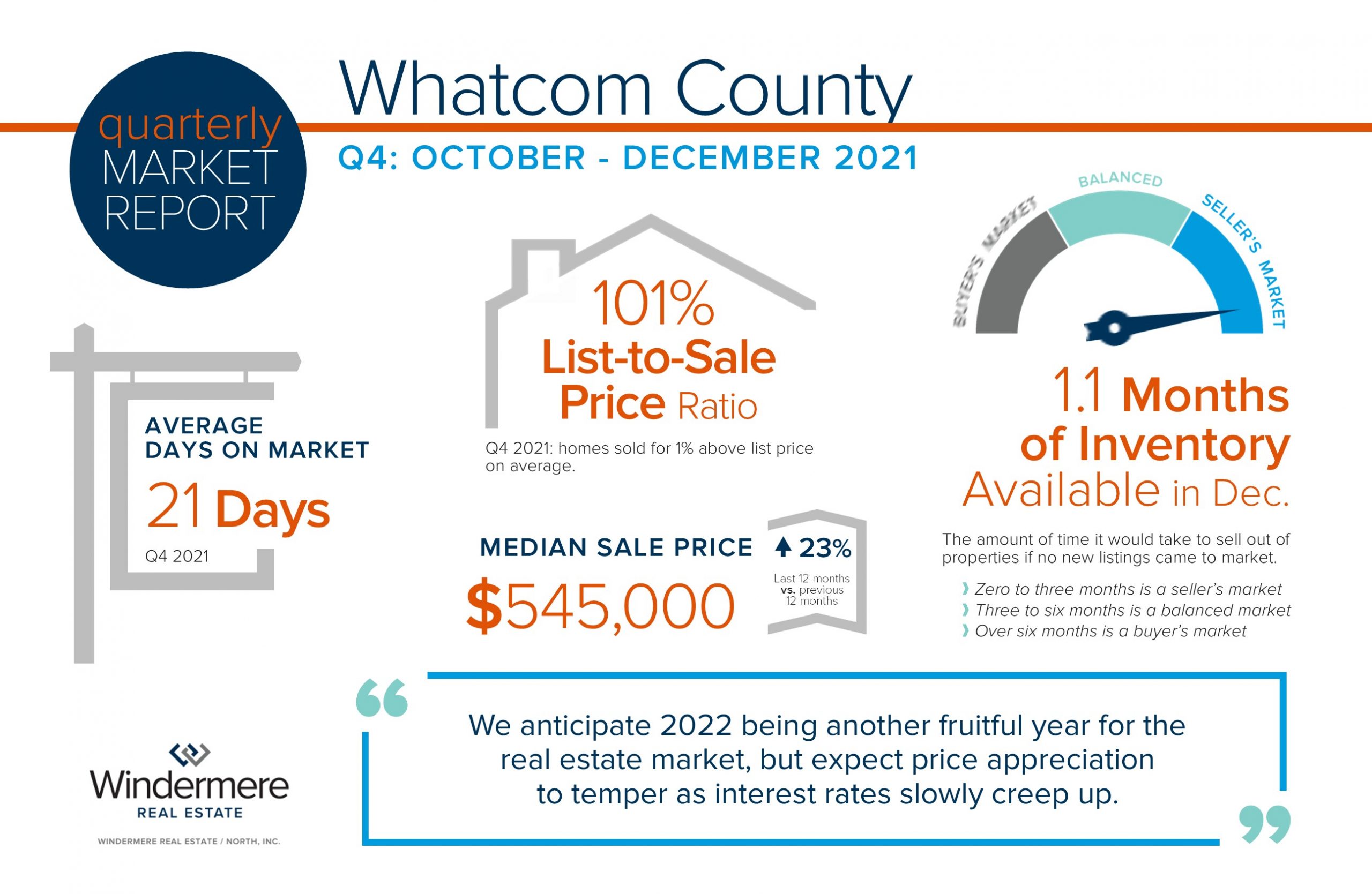

QUARTERLY REPORTS Q4 2021

2021 was a year that will go down in infamy in regards to the real estate market. Tight inventory levels, historically low interest rates and increased buyer demand influenced by pandemic lifestyle shifts made for an eventful year! 2021 price appreciation is on top of the strong price growth we also saw in 2020. Seller equity is undeniable as homeowners are sitting on top of a wave of appreciation that has been mounting since 2012! Wherever you sit in this decade of price growth, if you are considering selling, you will enjoy phenomenal returns. As for buyers, they are securing homes with low debt service which has helped offset the affordability of housing prices.

We anticipate 2022 being another fruitful year for the real estate market, but expect price appreciation to temper as interest rates slowly creep up. Look to me to continue to help keep you updated as the year progresses. It is always my goal to help keep my clients well informed and empower strong decisions.

2022 Predictions for the Real Estate Market

At Windermere, we have the benefit of being expertly guided by our Chief Economist, Matthew Gardner. Every year he shares his predictions for the US Economy and Housing Market. I have included a list of highlights below along with a link to a video where he spells it all out.

Matthew’s Forecast for the US Economy:

- The US will still continue to feel the effects of the COVID-19 pandemic on the economy. He acknowledges that we are healing, but still experiencing drag due to supply chain delays and Covid-sensitive consumers. He expects this to improve as we head into spring and the second half of 2022.

- He predicts a 4% increase in GDP in 2022.

- Even though we are still experiencing supply chain delays and labor shortages he does not anticipate a recession.

- He predicts more robust job growth in 2022 and returning to pre-Covid employment in the second half of 2022.

- Inflation is still very much affected by supply chain issues and labor shortages, but he sees that settling out mid-2022.

- Interest rates will help to counteract inflation and will start to increase in 2022, but not crest 4%.

Matthew’s Forecast for the US Housing Market:

- There will be a modest reduction in home sales year-over-year, but realize this is coming off of a high volume of sales in 2021.

- After a record-breaking 16% increase in median price in 2021, he predicts a 7% increase in median price year-over-year in 2022. This slow down in appreciation will be due to increased interest rates, affordability, and a slight increase in supply.

- Housing starts will increase, but more importantly, construction completion will increase due to supply chain issues and labor shortages improving.

- Interest rates will increase towards 4% as we travel through 2022, but will still be well below the 30 year average of 7.5%.

- There will not be a housing bubble due to high demand for housing, job growth improving, and the overall recovery of the US economy.

- He is not concerned about forbearance, but more so affordability for the aging millennial generation who would like to purchase their first home.

- He sees the housing market moving towards more balance in 2022 after an incredible year of growth in 2021.

Look for Matthew’s local economy and housing market predictions from me in January. My office is also hosting a virtual Economic Forecast event with Matthew on January 19th. Stay tuned for more information.

Overall, this is a positive outlook weighted with some real challenges that we still face as we recover from the global pandemic. It is always my goal to help keep my clients well-informed and empower strong decisions. Please reach out if you are curious about how the housing market relates to your goals or if you’d like to attend the virtual economic forecast event with Matthew in January.

Thank you to everyone who donated to our Thanksgiving food drive! Because of your generosity, we were able to give The Volunteers of America Food Banks a check for $3,075 and 2,169 pounds of food! That will provide a total of 3,498 meals for our community.

Thank you to everyone who donated to our Thanksgiving food drive! Because of your generosity, we were able to give The Volunteers of America Food Banks a check for $3,075 and 2,169 pounds of food! That will provide a total of 3,498 meals for our community.

Food insecurity is one of the most prevalent social issues of our time. VOA food banks, food pantries, and distribution center all exist to tackle hunger in our community and also serve as touchpoints to connect our neighbors with other basic needs.

Thank you!

This holiday season, I invite you to join me in this tangible way of showing gratitude and support to our healthcare workers, who have worked so long and hard under the most difficult circumstances.

This holiday season, I invite you to join me in this tangible way of showing gratitude and support to our healthcare workers, who have worked so long and hard under the most difficult circumstances.

In tandem with The Windermere Foundation and local non-profit We Got This Seattle, my office is collecting donations that will be used to purchase meals from local restaurants. We will be personally delivering these meals over three weeks to a coordinated point person at Providence Hospital in Everett, Swedish Edmonds, and UW Medical Center-Northwest. Meals and treats will be distributed to frontline workers such as nurses, doctors, respiratory therapists, and cleaning staff.

All funds collected through:

12/6-13 will provide meals to Providence Everett

12/14-20 will provide meals to Swedish Edmonds

12/21-27 will provide meals to UW Medical Center – Northwest

Thank you for your generous gifts in support of our community.

Happy Holidays!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link