As we celebrate the start of autumn, the season of change, the leaves on the trees are not the only things that are falling. Interest rates have gradually fallen throughout the year. Just 11 months ago, rates were almost 2 points higher; in the frothy spring market, they were nearly 1.5 points higher. During this same time, the median price in King County and Snohomish County grew. In King County, the median price was recorded at $975,000 this August and at $775,000 in Snohomish County, which are both up 7% year-over-year from August 2023.

Another trend that we are witnessing is a rise in available inventory for sale. August recorded the highest level of available homes for sale since the fall of 2022, two years ago. There were 3,105 available homes for sale in King County in August 2024 compared to 1,207 in January 2024, and 1,147 in Snohomish County in August 2024 compared to 374 in January 2024.

The combination of lower borrowing costs and more selection should be a welcome change for buyers. When the inventory was much tighter in the first half of 2024 and interest rates were higher, prices were increasing at a rapid rate. We are starting to see new buyers enter the market and some who have sidelined themselves return. This indicates that prices will remain stable as we finish out 2024.

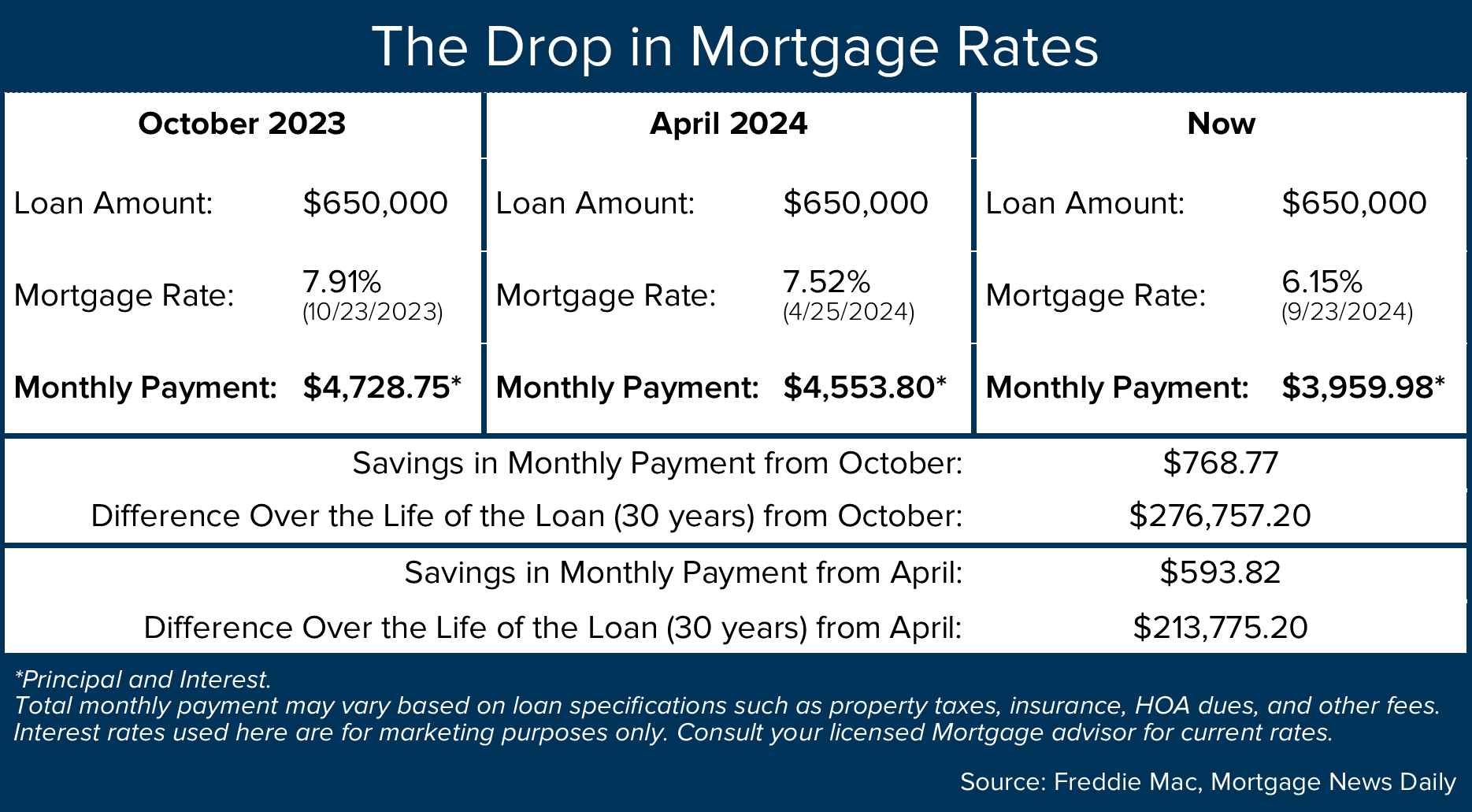

Currently, buyers have more selection and the opportunity to grab a lower monthly payment. As you can see from the chart below, buyers have a significant opportunity to afford a higher price point at a lower rate or stay at the same price point and have a lower monthly payment. The reduction in rate over the last year is reducing monthly payments and creating great long-term savings over the life of the loan. The rule of thumb for affordability is a 1-point shift in rate affects a buyer’s buying power by 10%. For example, a home priced at $800,000 with a 7% interest rate will have a similar monthly payment as a home at $880,000 with a 6% rate.

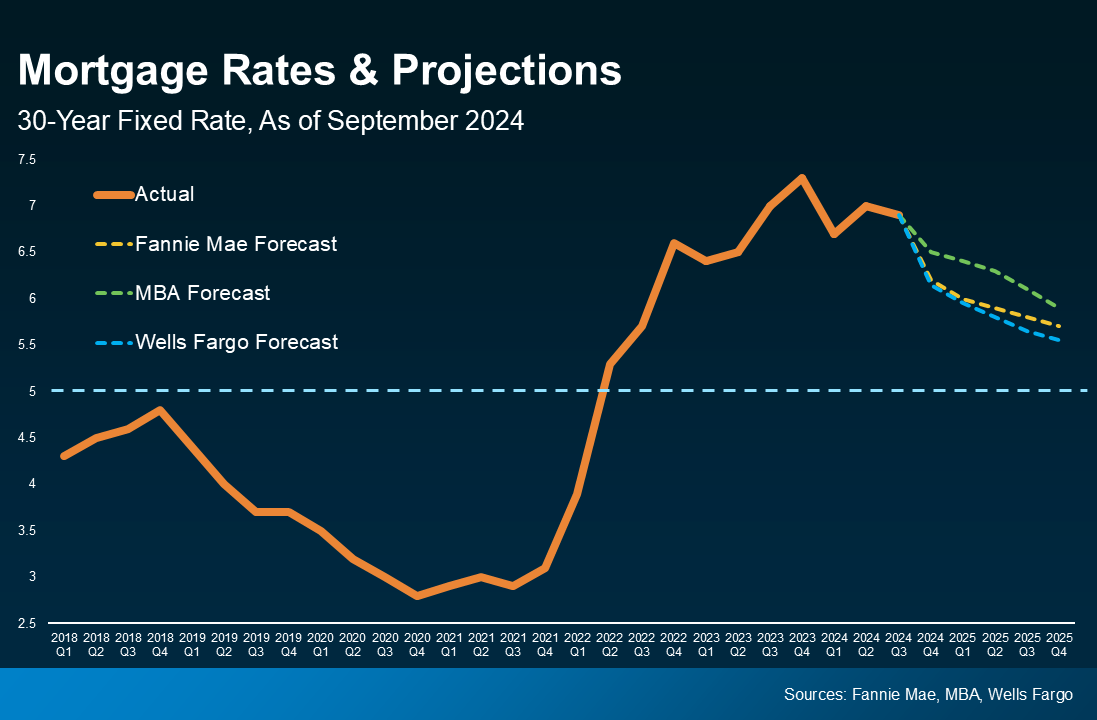

The hesitation we are seeing in the marketplace is a desire for rates to come down even further. The good news is that they are predicted to continue this gradual decline. Where we are concerned is a decrease in selection. If we look at seasonality, it is common for inventory to be low in the first half of the year, especially in Q1 (see the King & Snohomish graphs above). If rates continue their slide and fewer new listings come to market, buyers will find themselves duking it out in 2025. Right now, while there are multiple offers on some properties, there are more properties that are being negotiated into contracts with one buyer.

This has created a more nimble market, particularly for buyers who also have to sell their homes to reposition their equity into a downpayment. While tight inventory provides great leverage for a seller, many sellers are also buyers. Analyzing the market conditions to align the environmental influences to create the best possible outcome for your goals is paramount, and it will not be the same for everyone. Depending on our client’s goals, timing can vary.

Oh, and another sentiment we often hear is, “Will rates under 5% ever be back?” That is rather unlikely and will go down as a historic time in our economy. With that said, if you are in your “forever home” and you captured a historically low rate, kudos to you! Truly, so awesome! If you are not in the home that is right for you, now may be the time to curate a plan to get you into your next home. If homes were selling at a rapid rate and prices were appreciating this last spring with 10% less buyer power, we imagine next spring will be much of the same, if not more.

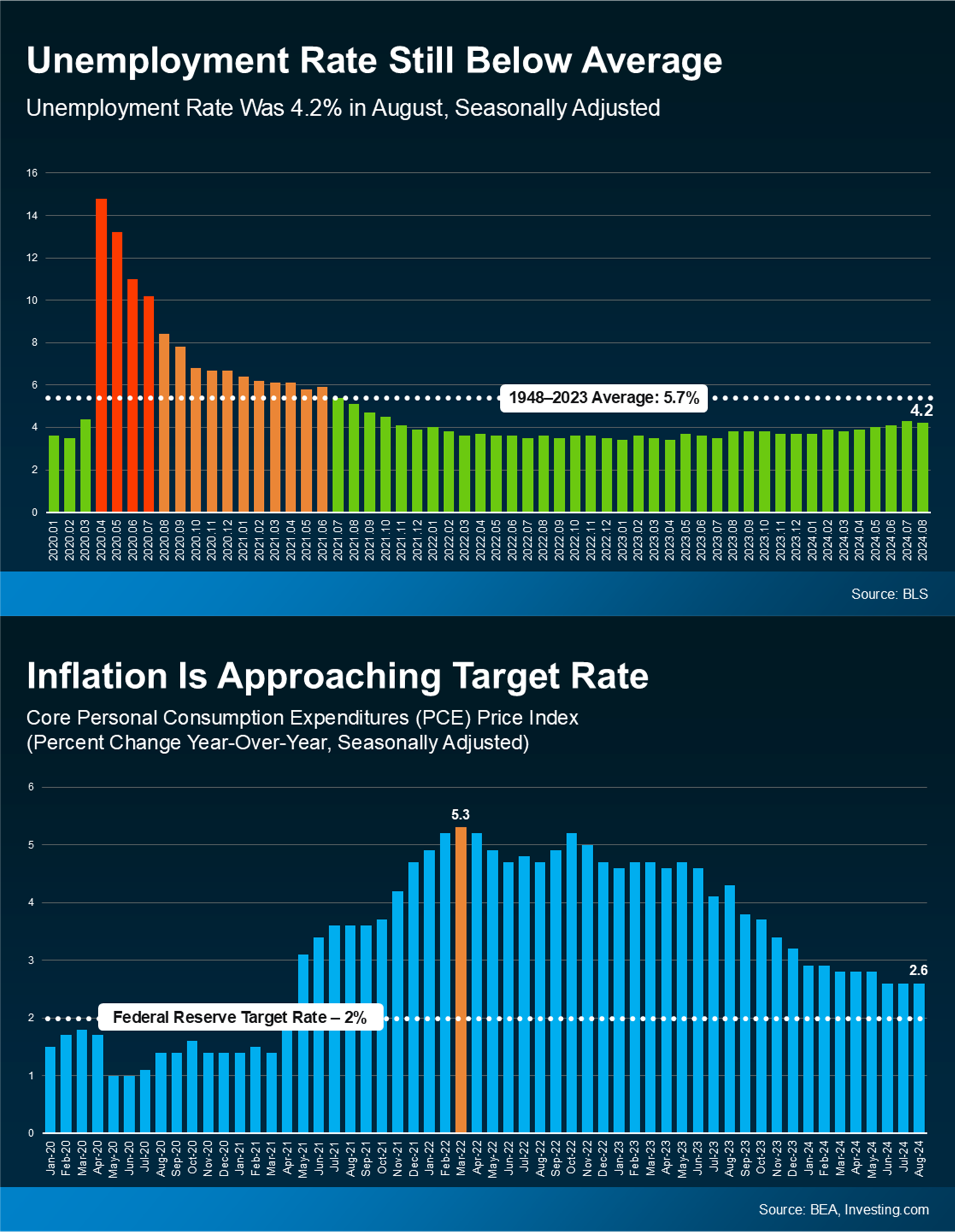

One final item to note is the election. History shows that post-election year markets are brisk with sales and experience price growth and rate decreases. We are paying attention to key indicators such as inflation figures, unemployment measurements, the gap between the 10-year treasury yield and mortgage rates, and our local market conditions in order to provide our clients with the most accurate and up-to-date information to empower strong decisions.

Are you curious how all of this affects you? Real estate is the number one tool for building wealth, and you also get to live there. We think that is pretty important, and we love nothing more than providing valuable insights, having strategic conversations, and helping people align their homes with their lives. Home is where the heart is and also where your nest egg has the most reliable long-term growth. Please reach out if you’d like to dig into the details and apply them to your housing and investment goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link